Cheyenne Credit Unions: Discover Top Financial Services in Your Area

Sign Up With the Activity: Why Federal Lending Institution Matter

In the world of economic organizations, Federal Cooperative credit union stand apart as pillars of community-focused financial, yet their significance extends beyond traditional banking solutions. They represent a standard shift towards member-driven monetary solutions that prioritize inclusivity and common development. As we unwind the layers of their influence on individuals and areas alike, it comes to be apparent that Federal Credit history Unions hold the secret to a more thriving and equitable financial landscape. Join us as we explore the complex tapestry of factors why Federal Credit scores Unions matter, and discover how they are shaping the future of economic empowerment.

Background of Federal Lending Institution

Considering that their inception, Federal Cooperative credit union have played a crucial function in the financial landscape of the United States. When the Federal Credit Score Union Act was signed right into law by President Franklin D. Roosevelt in 1934, the background of Federal Debt Unions days back to the very early 20th century. This Act was an action to the Great Depression, aiming to promote thriftiness and avoid usury by supplying affordable credit score to members.

The Act enabled groups of people with a common bond, such as workers of the exact same firm or participants of a labor union, to create lending institution. These debt unions were established as not-for-profit monetary cooperatives, had and operated by their participants. The participating structure made it possible for individuals to pool their resources and give access to budget-friendly loans and other financial services that might not have been readily available to them via typical financial institutions.

For many years, Federal Lending institution have proceeded to expand in number and influence, serving millions of Americans nationwide. They have actually remained fully commited to their beginning principles of community focus, member ownership, and financial inclusion.

Distinct Services Supplied by Lending Institution

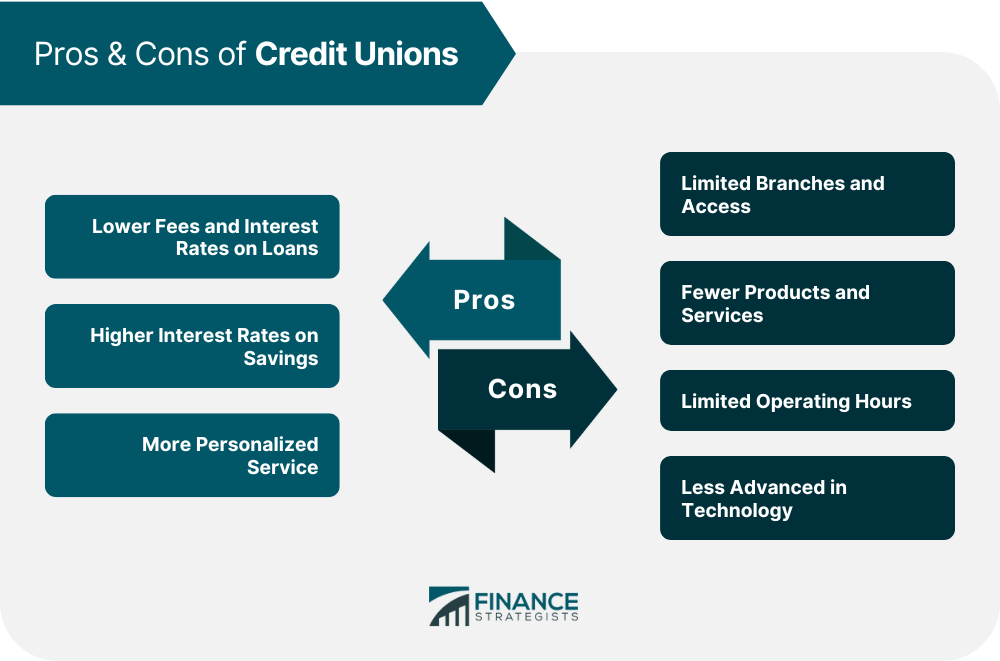

Furthermore, credit history unions often supply lower rate of interest prices on fundings and credit score cards compared to larger banks. This can cause considerable price financial savings for members, particularly for those seeking to obtain cash for large purchases such as vehicles or homes. Furthermore, cooperative credit union regularly provide higher rate of interest on cost savings accounts, allowing members to expand their money extra properly.

Another distinct service offered by cooperative credit union is profit-sharing. As not-for-profit companies, lending institution distribute their earnings back to participants in the kind of dividends or reduced fees. This cooperative structure fosters a sense of shared ownership and community among participants, reinforcing the idea that credit scores unions exist to offer their members' best rate of interests.

Benefits of Membership in Cooperative Credit Union

Signing up with a lending institution offers members a host of tangible benefits that come from the institution's member-focused approach to economic solutions. Unlike traditional financial institutions, lending institution are not-for-profit companies had and operated by their members. This unique structure permits lending institution to focus on the very best passions of their members over all else, resulting in numerous advantages for those who choose to join.

Neighborhood Influence of Lending Institution

Cooperative credit union play a crucial role in cultivating economic stability and development within local neighborhoods via Home Page their one-of-a-kind monetary solutions version. Unlike typical banks, lending institution are member-owned and ran, permitting them to focus on offering the very best rate of interests of their members instead than creating revenues for investors. This member-centric method equates right into concrete benefits for the community at large.

One considerable way credit history unions influence communities is by offering accessibility to inexpensive economic product or services. Cheyenne Credit Unions. From low-interest financings to affordable interest-bearing accounts, credit rating unions supply a wide variety of choices that help individuals and local business flourish. By reinvesting their earnings back right into the area in the type of lower fees, higher rate of interest on down payments, and much better lending terms, lending institution add to the overall financial wellness of their members

In addition, credit rating unions typically focus on financial education and learning and outreach initiatives, outfitting community participants with the expertise and sources required to make audio economic decisions. By supplying economic literacy programs, workshops, and individually therapy, cooperative credit union empower people to accomplish better monetary independence and safety. On the whole, the neighborhood effect of lending institution surpasses simply banking services; it expands to constructing stronger, extra resilient areas.

Future Growth and Trends in Cooperative Credit Union

Amidst evolving financial landscapes and moving customer preferences, the trajectory of debt unions is positioned for dynamic adjustment and innovation. As more purchases move to electronic systems, credit scores unions are improving their on-line solutions to satisfy member assumptions for ease and effectiveness.

Additionally, sustainability and social obligation are becoming key trends influencing the development of lending institution. Members are useful content increasingly looking for banks that straighten with their worths, driving lending institution to integrate social and environmental campaigns into their procedures (Credit Unions Cheyenne). By prioritizing sustainability techniques and area advancement jobs, cooperative credit union can bring in and keep participants who focus on moral financial methods

Verdict

In final thought, government cooperative credit union play a critical function in advertising financial stability, area empowerment, and inclusivity. Via their unique solutions, member possession structure, and dedication to reinvesting in the area, cooperative credit union prioritize the health of their members and add to building more powerful communities. As they remain to adapt and grow to transforming patterns, lending institution will stay a vital force in advancing economic independence for all people.

The background of Federal Credit history Unions days back to the early 20th century when the Federal Credit Rating Union Act was signed right into legislation by Head of state Franklin D. Roosevelt in 1934.The Act enabled groups of individuals with a common bond, such as staff members of the same business or participants of a labor union, to develop credit rating unions.Additionally, credit report unions often provide lower passion rates on lendings and credit cards compared to larger economic institutions.Moreover, credit score unions often prioritize monetary education and outreach hop over to these guys efforts, furnishing community participants with the understanding and resources needed to make sound financial choices. Via their unique services, member ownership framework, and dedication to reinvesting in the neighborhood, credit scores unions focus on the wellness of their members and add to constructing stronger communities.